Every business, be it large or small, is affected by the Affordable Care Act (ACA). ACA changes how organizations view health benefits, provide those benefits to employees and report on those benefits. According to ADP, many employers lack a true understanding of what ACA means for their business and are therefore failing to make the necessary plans to be in ACA compliance.

Every business, be it large or small, is affected by the Affordable Care Act (ACA). ACA changes how organizations view health benefits, provide those benefits to employees and report on those benefits. According to ADP, many employers lack a true understanding of what ACA means for their business and are therefore failing to make the necessary plans to be in ACA compliance.

ACA mandates stiff penalties for businesses that do not adhere to regulations, which can blind side an ill-prepared business.

The ACA provides different criteria for small employers and large employers, however, small businesses are not exempt from the regulations enacted by ACA. It is important that small businesses fully understand the ACA and what changes their organization needs to make in order to be in ACA compliance.

ACA Small Employer Definition

ACA defines small employers as those that have 50 or fewer full-time equivalent employees. To determine who is qualified as a full-time equivalent, each organization must analyze the average number of service hours an employee works per week. Service hours include:

- Hours worked

- Paid time off including vacation and holidays

- Jury Duty

- Unpaid time covered by FMLA or USERRA

For many small businesses, this calculation is different than what is currently used to determine full-time status. Therefore, record keeping, monitoring of hours and due diligence is required to ensure that each employee is being classified correctly.

Under ACA, small employers – those with fewer than 50 full-time equivalents – are exempt from the penalties outlined in the law. Employers that are near or are approaching the 50 employee threshold must pay attention to hours worked. Adding one employee with more than 30 service hours per week has the potential to move a business in to the large employer category and result in stiff penalties and fines if the organization is not in ACA Compliance.

ACA Compliance Requirements

Although small employers are not subject to penalties, they are still required to adhere to the ACA requirements for providing health coverage.

Types of Health Care Plans

In order to be in ACA compliance, employers must offer health care plans that include:

- Minimum Essential Coverage Plan (MEC): Offering MEC is the first trigger for penalties for businesses with more than 50 full-time equivalent employees. Large employers can face penalties of $2,000 per year, for all employees if 95 percent of eligible employees are not offered this option.

- 60 Percent / Affordable Plan: Employers are required to provide an affordable health care option. If an option is not provided and an employee receives a subsidy, the large employers can face penalties of up to $3,000 for each full-time equivalent that receives a subsidy.

Small employers are eligible to purchase healthcare insurance for their employees through the Small Business Health Options Program (SHOP). This marketplace can provide affordable options that small business may not be eligible for otherwise. Additionally, there are tax credits provided for small employers that have fewer than 25 full-time equivalent employees. These businesses may be eligible for tax credits of up to 50 percent of the employer-paid health care premiums.

Documentation

Documentation is important for a variety of reasons. First, it helps organizations ensure that they are providing a quality benefit to their employees and that all eligible employees are aware of their eligibility. Second, documentation provides assurance that the organization is prepared in the event of an audit. Documentation considerations include:

- Keeping record of when an employee becomes eligible for benefits. This may occur due to the number of days they have been an employee or once their average service hours per week equals 30. For both cases, it is important that even small employers have systems in place to consistently monitor for eligibility.

- Documenting that employees are made aware of their eligibility. Employers must have supporting documentation that verifies that each eligible employee was made aware of their status and had the opportunity to act upon it. To do this, employers can:

- Deliver eligibility information through certified mail requiring a signature receipt.

- Distribute documentation electronically requiring employees to acknowledge receipt. If this method is chosen, the electronic transmission must adhere to Department of Labor distribution requirements.

- Manually distribute paperwork within the organization with the requirement that employees sign a document acknowledging receipt.

ACA Compliance Impact

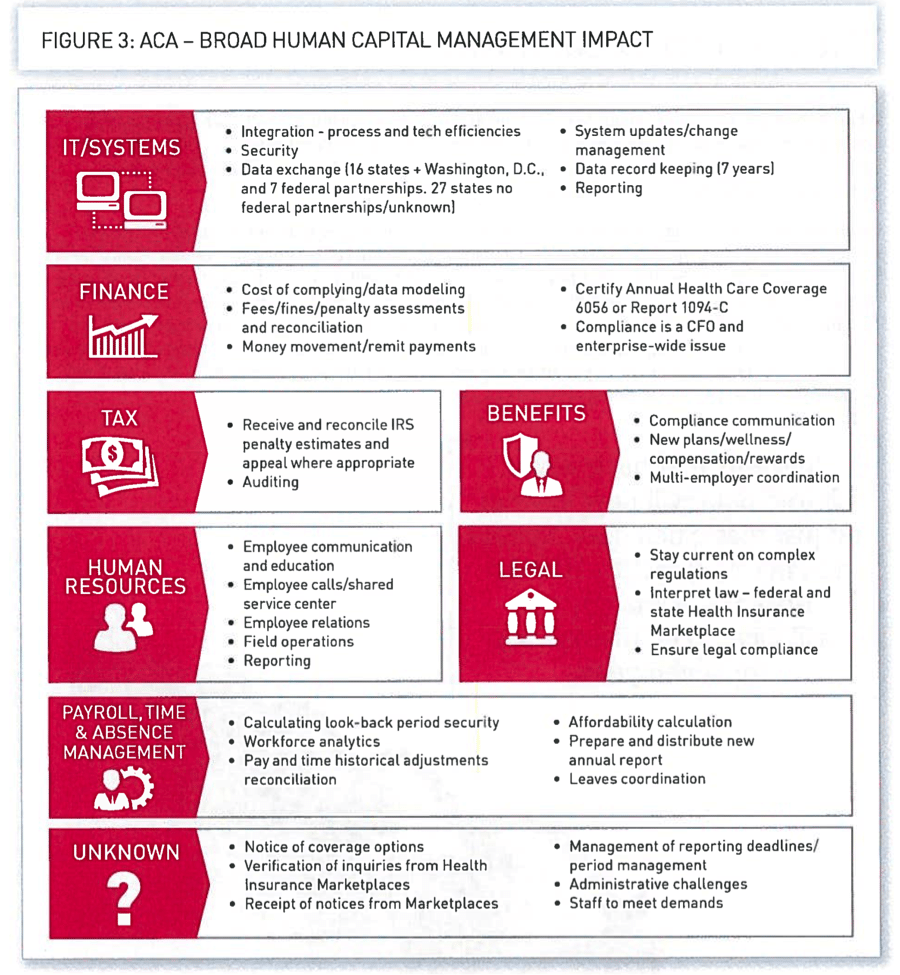

Typically, laws regarding business operations affect one or two areas of a business. The ACA is different. In order to be in ACA compliance, multiple departments within the organization must understand the requirements and adopt changes. In small businesses, multiple roles may be held by one individual. It important that those individuals understand that they must implement ACA requirements for each of those roles.

In order to ensure your organization is in ACA compliance, one or more individuals should be tasked with managing the compliance process. This individual would be responsible for scheduling meetings and regular follow-ups to ensure all responsible parties are planning for and implementing changes. This individual would also need to take a high-level approach to the ACA initiatives to understand how each of the individual department changes is impacting the organization.

(Figure 3 provided by ADP)

ACA Compliance Preparedness

The Affordable Care Act enacts a number of requirements for how health care benefits must be provided, administered and documented. Although small employers are not subject to penalties, it is important that all business understand what is necessary to adhere to ACA guidelines. It is important that organizations – particularly those small employers that are in a growing phase – monitor employee eligibility. Once a business as 50 full-time equivalent employees, it is possible to begin incurring fines.

Using the service of a qualified, professional consultant can help to ensure your business is ready and able to comply with all ACA regulations. By understanding the unique needs of your organization, skilled consultants can help to create a plan to become and remain ACA compliant. The business experts at Smolin Lupin have decades of experience providing key support to organizations.